AB Dynamics plc Annual Report 2025

Operating profit growth and margin expansion

Having invested in our Group product range, capability, leadership and new product development and along with leveraging our existing core strategy and technologies, the Group has made a strong start to delivering the medium-term growth plan despite a more challenging backdrop during the second half caused by macroeconomic and geopolitical disruption.

Highlights of 2025

Strong start to delivering the medium-term growth plan

Revenue

£114.7m

+3%

(2024: £111.3m)

Adjusted* EBITDA

£27.8m

+15%

(2024: £24.2m)

Adjusted* operating profit

£23.3m

+15%

(2024: £20.3m)

Adjusted* operating margin

20.3%

+210 bps

(2024: 18.2%)

Cash conversion

106%

(2024: 115%)

Net cash

£41.4m

(2024: £28.6m)

Adjusted* diluted earnings per share (EPS)

80.3p

+15%

(2024: 70.0p)

Dividend per share

9.16p

+20%

(2024: 7.63p)

* Adjusted to exclude amortisation of acquired intangibles, acquisition related charges and exceptional items.

Acquisition of Bolab

A leading provider of niche automotive power electronics testing solutions

During FY 2025, the Group acquired Bolab Systems GmbH (Bolab), a leading provider of niche automotive power electronics testing solutions. Bolab is a specialised manufacturer of low-voltage and high-voltage equipment which are critical for testing and validating automotive sub-systems and components for conventional, EV and hybrid vehicles.

Chairman's statement

We made a strong start to delivering our value creation plan with profit growth slightly ahead of expectations, margin improvement and the acquisition of Bolab, despite challenging macroeconomic circumstances.

Richard (Dick) Elsy CBE

Non-Executive Chairman

Market drivers support growth

New vehicle models

New vehicle models

The emergence of electric vehicles and new entrants into the automotive market as well as developments in autonomy has led to significant increases in the number of new model launches. While the volume of EVs sold is growing more slowly than originally predicted, the number of available EV models is expected to nearly double over the next ten years. In addition, the slower transition to EVs is leading to renewed growth in hybrid platform development, with ICE vehicles expected to be around for longer, supporting significant levels of activity in new platform development.

Our solutions:

Testing products | Testing services | Simulation

New powertrains

New powertrains

Increasing concerns about the environmental impact and the predicted scarcity of fossil fuel supply have made energy efficiency and reduced emissions a primary focus of OEMs and a primary selling point for new vehicles. OEMs are developing EVs and hybrid alternatives to the traditional internal combustion engines, and continued development of alternative fuel sources such as e-fuels and hydrogen, hybrid drivetrains and new technology continues to drive the market for vehicle development toolchains.

Our solutions:

Testing products | Testing services | Simulation

Consumer ratings

Consumer ratings

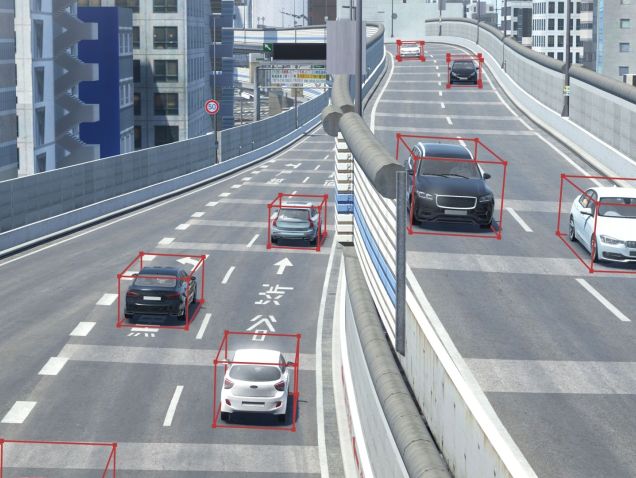

Consumer bodies such as Euro NCAP (New Car Assessment Programme), Japan NCAP and China NCAP are independent safety organisations that provide car safety ratings determined from a series of vehicle tests which represent real-life accident scenarios. In order to obtain an NCAP safety rating when launching a new vehicle model, each variant of that model must be certified by an NCAP test laboratory. The development of new technology means that certification requires an increasing number of increasingly complex tests. Many of our products and services are used in the development and certification of these vehicles.

Our solutions:

Testing products | Testing services

Regulation

Regulation

In addition to consumer ratings, the market for ADAS and active safety is driven by regulation from bodies such as the United Nations Economic Commission for Europe (UNECE) and the US regulator, the National Highway Traffic and Safety Administration (NHTSA). With an estimated 1.35m road deaths per year, of which a growing number are in the USA, there is growing pressure on regulators to improve standards, leading to further increases in the number of requirements and hence the number and complexity of tests required.

Our solutions:

Testing products | Testing services | Simulation

Delivering our strategy

Strategic objectives:

Product and innovation

Market-led new product development with a focus on research and innovation.

Capability and capacity

Building a platform for long-term sustainable growth.

Acquisitive growth

Clear and defined acquisition criteria of value-enhancing companies that facilitate the Group’s strategic priorities.

Service and support

Transition towards a greater proportion of software as a source of higher margins and recurring revenues to meet the market’s needs as requirements become more complex.

International footprint

Increase the Group’s international footprint in customer-led locations to increase customer intimacy, customer support and market intelligence.

Diversification

Diversification into new adjacent markets utilising the Group’s core technology and capability.

Chief Financial Officer’s review

Strong start to executing the medium-term growth plan, margin improvement supported by strong cash generation.

Sarah Matthews-DeMers

Chief Financial Officer

Embedding sustainability

Sustainability roadmap

As a Group, it is our core purpose to accelerate our customers’ drive towards net zero emissions and to improve road safety and the automation of vehicle applications. We do this through leadership and innovation in engineering and technology and we are well placed to support the transition towards a more socially and environmentally sustainable economy.

Sustainability is an intrinsic part of our core purpose to accelerate our customers’ drive towards net zero emissions and to improve road safety and the automation of vehicle applications through leadership and innovation in engineering and technology.

Louise Evans

Chair of the Sustainability Committee